With the current political climate & the high cost of living in Portland with disabled kids, we often discuss leaving…

Warning: This is a very personal (and very long) piece, written with an audience in mind (my readers) that already knows a lot about me and my work – and I understand it contains details that may not be of interest to someone who is not familiar with my advocacy work or my story… if that’s you, you may just want to skip reading this one! 😉 I think this piece may be of particular interest to my readers who do NOT live in the United States — as it gives a unique picture of what it is like (and what it costs) to live here now. Perhaps this essay will be in my next book someday (I’ve gotta get the first one to press and into people’s hands though, before I can think about the next one, lol!)

For those new to the Lead Safe Mama website:

Tamara Rubin is a multiple-federal-award-winning independent advocate for childhood Lead poisoning prevention and consumer goods safety, and a documentary filmmaker. She is also a mother of Lead-poisoned children (two of her four sons were acutely Lead-poisoned in 2005).

- Tamara owns and runs Lead Safe Mama, LLC — a unique community collaborative woman-owned small business for childhood Lead poisoning prevention and consumer goods safety.

- Since July 2022, the work of Lead Safe Mama, LLC has been responsible for six product recalls (FDA and CPSC).

- All test results reported on this website are science-based, accurate, and replicable.

- Please check out our press page to see some of the news coverage of our work, linked here.

With the current political climate, and the high cost of living in Portland with disabled children in 2019, we often discuss leaving… the country.

“Tamara, what do you want to be when you grow up?”

With all that has been going on in the world politically these days, I have given serious thought to restructuring my life so that I can finally be more focused on my kiddos and less focused on my work (which was my original goal when I met my husband 18 years ago, and was actually the main reason we moved to Portland in the first place — so we could “settle down” and I could “stop working”, and shift my life-balance so that I could be a full-time stay-at-home mom!)

“I just wanted to be a mom & take care of my kids!”

As a quote from my documentary, MisLEAD: America’s Secret Epidemic goes (you can watch the scene here), I just wanted to be a mom and take care of my kids. Being a “just” a mom is a goal that has always been my top priority (since as long as I can remember – since I was maybe 4 or 5 years old!) This was probably (ironically) because my mom was always working [running her successful small business out of our home and on the road — designing, making, and shipping her unique pottery out to individuals, and department stores all over the country, and selling, selling. selling — at festivals, craft fairs and trade shows] — but not ever really “there for us” when she was home. We made up for this by traveling with her a lot, spending lots of time with her when we went on the road for work (like the NY Gift Show, SF Gift Show, and craft shows up and down the Eastern Seaboard – like The Big E, etc.), and vacations [summers spent living and sailing on our boat – between craft shows!]

I remember clearly being a very young child and collecting handmade stuffed dolls (from our work trips). I would “take care of them” – and play with them like they were my babies. When I was 9 years old I started babysitting (for $1.00 an hour), and by the time I was 10 years old (1979), I had started a summer “daycare”, where I watched multiple kids during the day at my home (usually 3 or 4 toddlers and babies) – and was paid $2.00 an hour per kid! Later, when I was in college in New York City (and I needed to pay my way through school), most weeks I babysat 8 shifts a week – seven nights + Tuesday afternoons(!), and it was one of my nanny jobs in NYC that eventually brought me to Paris – where I wound up living (1989/1990), and continued to nanny (for a French family), while taking classes through the Theatre du Soliel and the Sorbonne!

I have always loved kids and I loved being with kids and taking care of kids, and my skills engaging children in creative play (along with my other by-that-time well-honed skills – like diaper changing and bottle warming…and probably especially my patience with tiny babies and all that comes with that) got me referrals to a whole cluster of fairly famous SOHO artists with babies in 1987/1988/1989… I had so much fun taking care of these kiddos and being part of their families! While I have lost touch with some of these families, I ended up staying in touch with many of them for years afterwards.

…oh yes — and a “Jewish Mom”….

Not only was being a mom important to me from a very early age, but being a Jewish mom was VERY important to me – passing my culture and my family heritage on to my children, so they could appreciate where we came from, how we got here — and the long road travelled along the way as the foundation for their future. Fast forward to today (September 2019)… I am a 49-year-old (almost 50!) Jewish mama of four (Jewish) sons in 2019. I had no idea back in the day that I would be dealt this particular hand, of course — of being the mother of children with disabilities. [If I had had any magical means of knowing this would be my future, I would have done many, many things differently!]

Being a Jew, and an environmental activist (and a parent of disabled children) living in “Trump’s America” – makes this a very scary time, a time to start considering new options – like my Polish & Russian ancestors did more than 100 years ago.

“So, how Jewish are you?”

Funny you should ask! In fact, a DNA ancestry test that was recently gifted to one of my kiddos showed that he is “74.6 %” Jewish! Of course I already knew this (because my husband is 100% Jewish, and I knew I am 50% Jewish – on my mother’s side), but what I did not know (and learned from the documentation that comes with the test results) is that it is actually a very rare thing to be “75% Jewish” in America today! It turns out that most American Jews (of Ashkenazi ancestry) are typically only “25% Jewish”, and it is even rare to find American Jews who are “50% Jewish” — because of the length of time most Jewish families have been in the United States – time during which many have married and had children with people from different ethnic /ancestral /geographical (non-Jewish) origins (as my mother did).

On my mother’s side my children are actually 4th-generation American Jews (in point of fact actually, practically 4th-generation San Francisco Bay Area Jews!):

- My grandfather – Arthur J. Glickfeld – was born in San Francisco, c.1913 (I need to look up the exact date!).

- My mother – Helene Nancy Glickfeld – was born in San Francisco in 1942.

- I was the exception [born in Saginaw, Michigan in 1969, and spending my childhood in the New England before my mom eventually returned to rejoin the rest of her large family “back home” in San Francisco, followed by my sister, and then by me, in 1990!]

- My eldest son was born an hour’s drive north of San Francisco – in Santa Rosa – in 1996.

On my father’s side, we have been in the United States even longer than that:

- M grandmother, Martha Smith, born in Portland, Oregon, c. 1925.

- My grandfather, Harvey W. Budgett, Sr. – born in 1921 [somewhere in Utah], he just passed away in Portland a few years ago.

- Harvey Sr.’s father – James Harold Budgett (my great grandfather) – was born in Todd, Minnesota in 1891.

- James’ father (my great, great grandfather) – Henry Holland Budgett – was born in the U.S. in 1862 (possibly in Kansas).

On my husband’s side, my children are also 3rd-generation American Jews.

“Thanks for the history/ genealogy lesson – let’s get back to 2019″…

So now… again… “Trumps America” + Jewish + disabled kids + environmental activist = ???? … Yikes! As a result of all of these elements combined we have (as a family) started taking a hard look at what it takes to live in the U.S.A. (in Portland, Oregon) today – specifically, how incredibly much it costs (both the extraordinary financial challenge, and so many other, “less-tangible” costs) — and what alternatives are out there that might allow for a “better life”.

Sad irony, this — 3 or 4 generations ago, our ancestors fled oppressive conditions and systemic hardship to come to this country in search of a more tolerant, enlightened and healthy environment in which to live and raise their families…and now we are thinking seriously about leaving for what are – while specifically different in context and degree – very similar reasons! [Not the least of which is the relatively extreme cost to cover simply basic needs for our family and our Lead-poisoned kiddos.]

The cost of living in Portland, Oregon…

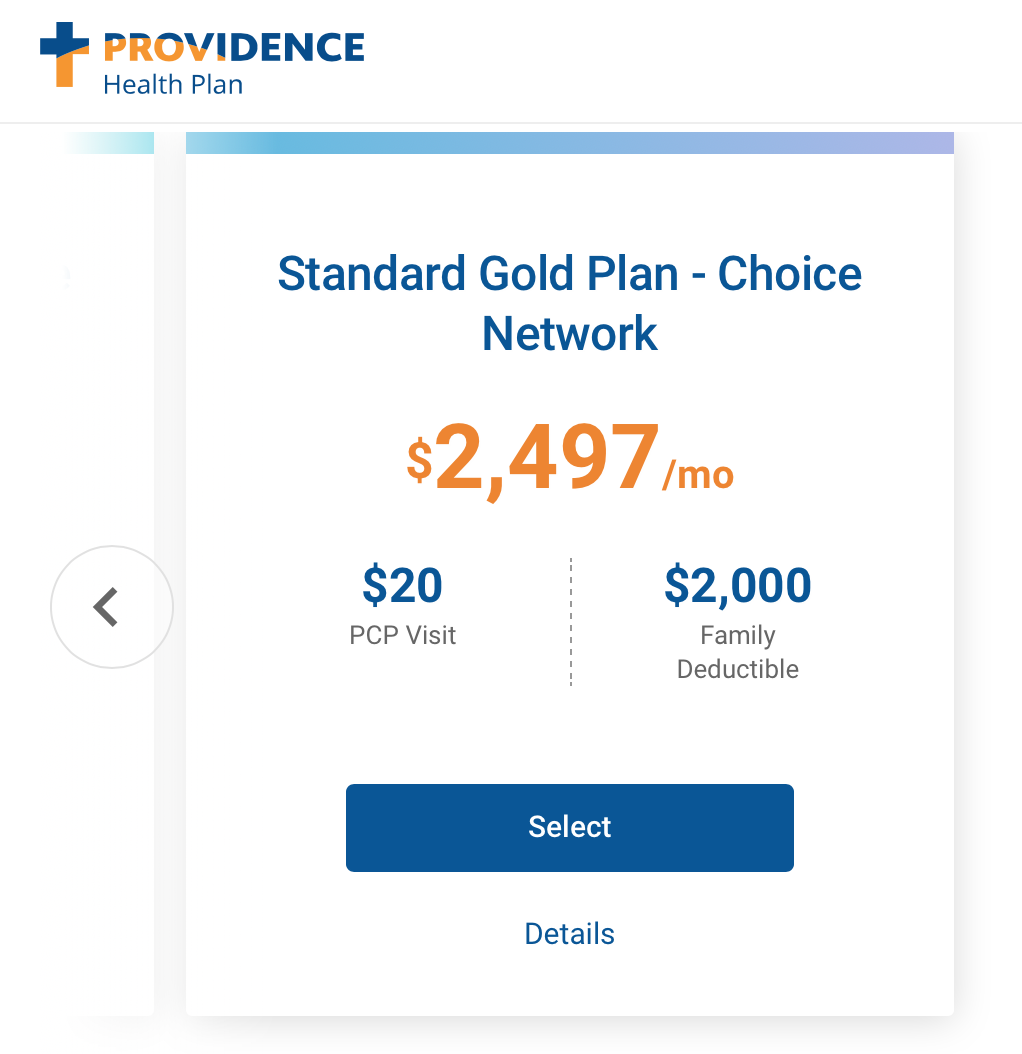

The cost of living here is INSANE (even to just live with basic things, like making sure your mortgage (or rent) is paid, and that your family has access to healthcare)… The image below is a draft spreadsheet of what it might cost to live here if you made a certain income and paid for everything that was required – without getting any public assistance (I will break it down below the image):

Please continue reading below the image.

Click the image below to see it larger/full size.

I have always said that for a family of 6 (like ours with four kids, three of whom have some level of disabilities) to live “normally” (not even “comfortably” – but just “normally”/not in overt poverty) in Portland, Oregon would take at least $10,000 a month. I know this is the case not only from the academic exercise of breaking down the costs (like in the spreadsheet above, and the breakdown below) – but also because there were a handful of months (when my advocacy work was taking off… when I was finally actually getting paid appropriately for my work [and before the attacks of the past 3+ years started*]) that I was actually making that much (more than $10k a month) — and was actually able to pay the bills, pay down some of my long-term debt – and I even had a bit of time to breathe! *If you aren’t familiar with my legal battle of the past three years, you can read all about it here – link.

Please note that while I know that it would take at least $10,000 a month to live a life without great struggle in Portland, in recent months our family has actually been bringing in closer to $2,000 to $3,000 a month. Our personal income is so low primarily due to the fact that as a practical matter, most of the money earned by my business needs to be put first and foremost towards my business expenses, which have been more than my income in recent years (again – primarily as a result of the legal battle), effectively making our average personal income over the past three years far less than $0/month.

“Huh — what?!”

In 2018, my business (gross) income was down to about $59,000; my business expenses were about $73,000, primarily due to all the ongoing legal teams’ fees, as a result of the need to defend against the attacks on my advocacy work. In the first six-months of 2019, my business gross income was really great (compared to 2018) – just under $62,000 (putting Lead Safe Mama, LLC on track to earn twice as much in 2019 as I earned in 2018) – but my business expenses were also just under $62,000 during those first six months – again, primarily because of the legal battle. So while I am confident the expenses outlined in the spreadsheet above would normally be pretty accurate (low) estimates, for now they haven’t reflected our actual current spending, because we simply haven’t had the available funds.

Here’s the breakdown of that approximate $10,000 a month living expenses budget (& why even that is not enough):

- House Payment: There’s not really any wiggle room here. $2,150 is just about the exact cost of our house payment (including taxes and insurance, but not including things like late-fees and unexpected assessments.) If you were to rent a 4 bedroom/ 2+ bath house in a good (safe) neighborhood in the city of Portland today it would easily cost quite a bit more. For context, studio apartments 2 blocks from our house are renting for $1,200 a month. Just looking on Craigslist today for available comparable rental homes elsewhere in the city (there are not really any in our neighborhood – as homes in our neighborhood are primarily owner-occupied) – I found rents in the range of $2,950 to $3,350 a month — and mind you, that’s for older houses, that I am certain have active Lead hazards [which the landlords are probably not even aware of!] And for those outside of the United States, please realize that Portland is NOT the most expensive city here, by any means; a good friend of mine was recently looking for rental houses in Santa Monica, California, and her budget ($7,500 to $9,000 a month) was on the “low” side for her search for a three bedroom house in good shape in a good neighborhood… (and that’s just for rent)!

- Utilities: $800 a month is a low estimate. Our electric and gas bills in the winter can get very high, sometimes bringing our monthly utilities alone to over $1,100 a month. These expenses (in Portland) include garbage/recycling, water/sewer, electric service, natural gas, and phones. [Note: a portion of my phones are covered by my business, so this is only including the personal component of our total telephone costs.]

- Food: $1,500 a month is a low estimate. Given we have three growing boys at home (all high-energy, nearly six-footers!) [one kid is away at college – on full scholarship – and on a meal plan, thank God!], plus two adults — combined with the fact that we do our best to eat all Organic (for both environmental reasons, and for health reasons – some related to our children’s disabilities), if we HAD the money to buy all the food our kids needs and wanted (healthy, natural, Organic food) it would probably be closer to something in the $2,000 to $2,500 a month range! Food in Portland is EXTREMELY expensive. If you don’t buy your food from Walmart, Grocery Outlet, Costco, etc. (or buy in bulk – which we try to do whenever we have enough $) it’s hard to economize. This is compounded by the fact that – as an environmental stand – we are car-free and can’t simply “jump in an automobile and drive out to a big box store”, and therefore are more likely to shop at our local natural foods store – which is just a few blocks from our house. Also please note that with three hardcore vegetarians/vegans in the home, a main staple of our diet is Organic nuts and seeds, which tend to be very expensive. I also want you to know that I am not “tone-deaf” — I know that the thought of spending this much money on food seems quite insane to some families – but remember we are talking about what would need to be spent in an “ideal scenario”, in the overpriced city of Portland, Oregon, if funds were available. [Something that we found very interesting when we went to Denmark with the family a few years ago…1) MOST of the food there is organic and 2) here we expect that groceries will often cost $100 a bag, but in Denmark we bought four bags of organic food (including a smattering of packaged foods), and it was only $68 for the four bags — we were floored!]

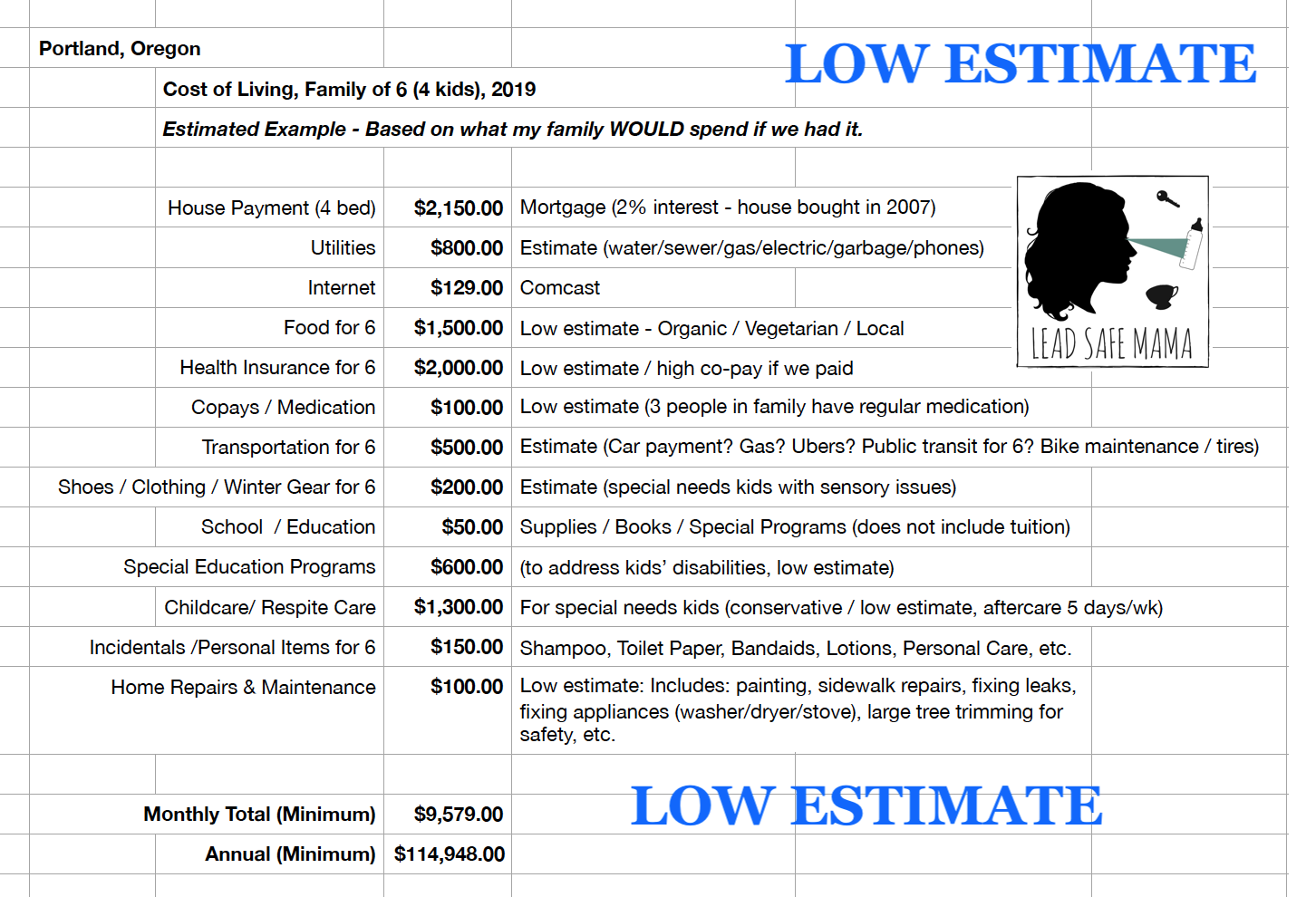

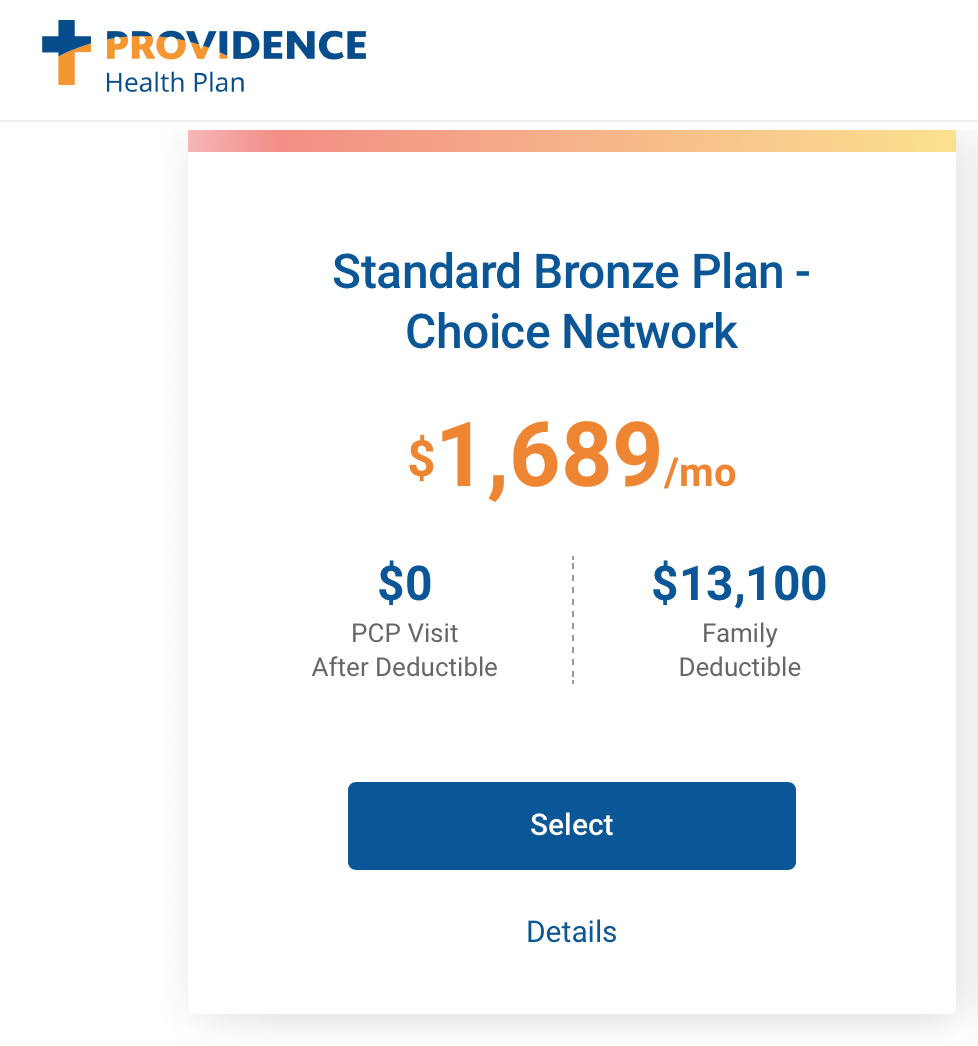

- Health insurance: Now this is a really big one; as a very-low-income family in the United States (which we have unfortunately been for nearly all of the past 3+ years since my legal battle started, and for periods before that as well), we have free health insurance, with no copays whatsoever. The instant we manage to make over $3,900 a month in income, after business expenses (and that’s a ballpark number), we will be disqualified for this benefit and will need to pay for our health-insurance out of pocket. The cost of this expense is greater than it may be for others, because we are self-employed and cannot get access to a less-expensive employee group plans (that in many cases also include better coverage and additional benefits, such as full dental or vision) simply because we don’t work for someone else. As a result – if we are making enough money to pay our own costs [the $10,000+ a month goal] the minimum cost for us to get “bare-bones” (dreadful) Health insurance [a cost further increased because of my age (49), and my husband’s age (61)] – with high deductibles and “out-of-network” costs, high co-pays, and prescription costs is about $2,000 a month (higher when accounting for all payments towards the deductible – see the image below). More reasonable coverage health insurance (with lower out-of-pocket expenses, and ideally, coverage for things like acupuncture, and naturopaths, and preventative care; a much lower co-pay, and better coverage of prescriptions) is more likely to be in the $2,500 a month range for our self-employed family of 5 (with our sixth away at college.) For fun, I just looked up Providence (because it is supposed to be one of the better plans locally, here in Portland) and their monthly cost is $2,497. Please note that because they are a CATHOLIC organization, they do not cover things like permanent birth control solutions (tubal ligation, or vasectomy) – and on principle, this is not a plan we would likely choose!

Below are screenshots for two actual plan options pulled up today (9/28/2019) for Health insurance from Providence Health Plan for a family of five with my family’s profile. With the first option if you budget to spread the deductible across 12 months the monthly cost actually works out to $2,781!

Without fully discussing every single additional category on the above spreadsheet, I will briefly address three more categories – as they account for some of the larger costs in a “best case scenario”:

- Transportation: The $500 a month stated above is probably really low for the “average American family”. Most families have a car payment, gas, car insurance, maintenance and repairs, parking fees, license and registration fees, and additional “hidden costs” of owning one or more automobiles to consider [my husband says, “see Ivan Illych’s fascinating 1974 essay, Energy & Equity to learn more about how and why we made such a big leap (and moved to Portland 17 years go in the first place)!”]. As a result, in a more ideal scenario (spreadsheet below) I put monthly transportation at $650 a month. Since we do not own an automobile, this might mean renting a car for a week (to run a bunch of longer errands, and incorporating an out-of-town family excursion, perhaps – consolidated into a few days) – about $250, plus bus passes for the kids (and regular bicycle maintenance and upkeep on 6 or more bicycles and bike trailers!). We also like to have emergency money available for Ubers – in case we need last minute auto-transportation for unanticipated appointments clear across town – particularly in inclement weather.

- Childcare / Respite Care: In my conservative scenario (above) I have the number listed as $1,300 a month. This is accounting for 52 weeks a year, 4 hours a day (afternoons), 5 days a week of care for my disabled kiddos, at $15 an hour. The truth of the matter is that good respite care workers cost $20 an hour or more – and if I actually want to get anything done (like work full-time – without having my kids staring at screen media so I can work – or travel for work, etc.), given I have two kids with fairly significant disabilities, I could easily spend twice that or more. In the past, I have often had two childcare providers at once when I really needed to get stuff done. So the $2,600 below is even conservative – since it doesn’t cover care for weekends, or when I travel out of town for work, and that sort of thing (nor an appropriate rate of pay for each of these providers of $20/hr +). Additionally the “Special Education Programs” line item could also be much, much higher if I had fully-appropriate care and services. I just recently found an appropriate program for just ONE of my sons (my older son, who has a brain injury) and it is $6,555 a month for a 9-month program!

- Home Repairs/ Maintenance: This is minor, as far as the line items go, but I want to be clear that as with most of the other items the $100/month number listed in the spreadsheet above is actually unrealistically low. Some examples: We have street trees that by City law we are required to maintain and prune. These trees are each between 60 and 80 feet high, and trained climbers who are also trained arborists need to be hired to take care of pruning them each year (last year one of these trees dropped a huge branch on a car that was parked under it – luckily no one was in it at the time – so maintaining these trees is really a potential matter of life and death and as such, a non-discretionary expense.) Regular maintenance of these trees alone can be $1,000 to $1,500 a year. Another example: The city decided the section of sidewalk in front of our house needed to be replaced [it was a little bit uneven, near the trees, but not really bad — and it was in no worse shape than many other sections near large old trees in our neighborhood] – and they hired a private contractor to replace a couple of squares of sidewalk, and sent us the bill. So we have an outstanding balance with them (that we have not been able to afford to make payments on) of more than $5,000! Reasonable payments – just for our sidewalk repair bill with the city – are in the neighborhood of $200 a month… and that doesn’t include periodic household repairs and maintenance issues – like broken dishwashers, clogged drain lines, etc. – so in the “updated”/more realistic estimate below – I made that number $300 a month, but it could easily be $1,000 a month – given how far behind we are on maintenance we are now on our property over the past 13 years.

…. and of course this budget does not include any discretionary expenses — “extras”, like vacations (for example!)

Where does that leave us?

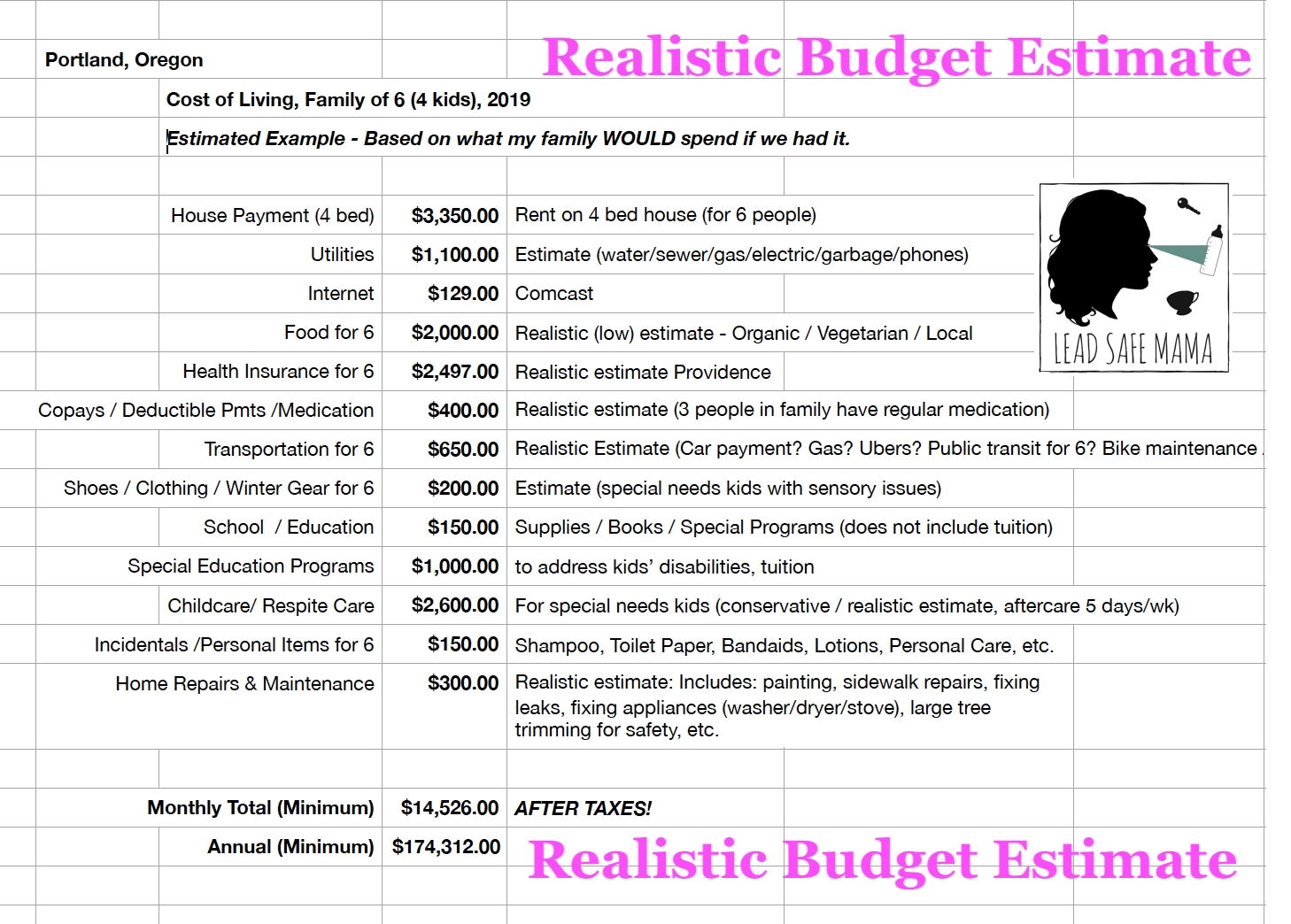

Making adjustments to the previously estimated $10,000 a month basic figure – based on the above considerations (as well as a few others), a realistic budget for our family to live “normally” (not in poverty) in Portland, Oregon, in 2019 (paying directly for all of our costs, and not using any public assistance benefits) is closer to $15,000 a month – and that’s what the number would need to be AFTER taxes had been deducted (see revised budget below.)

If we were making money in that tax bracket our taxes would be much higher (but we would still have deductions related to owning our home and having children) – so would probably need to make at least $17,000 a month to make sure to cover taxes in this scenario (possibly more – I don’t really know, as I haven’t been in that tax bracket – with four kids. ;-))

It’s no wonder so many U.S. families continue to live in poverty. You simply cannot afford to make “just enough” to cover your expenses – as, in most cases, that will mean you lose critical benefits (like healthcare and respite care) and your cost of living will instantly double.

Continue reading below the image.

Click the image below to see it larger/full size.

And so, I started the following inquiry via a Facebook post: “Where could you live comfortably for less? How about, say, $3,200 a month?”

In response to ruminating over the insanely high cost of living here (in the United States and specifically in Portland, Oregon), I recently posed the following question on my Facebook page (you can click through the image below to read it and all of the comments).

I started this inquiry because I can see – in the near future – the expenses (and debt service!) from the legal battle diminishing (and my debts to countless friends being repaid), and know that my “passive” income (income I can make solely from my writing and work on social media without needing to travel or incur too many expenses — income I can earn with my kids underfoot at home, income I can earn while working remotely and traveling pretty much anywhere in the world as long as I have an internet connection) will be in the $3,000 to $3,500 a month range… and I was curious where that could take me if we made some big shifts (once A.J. heads off to college, and we are left with “just” two children!)

The amount (and range) of responses and ideas on this post have been staggering – and the conversation has been very interesting too! It was this conversation on my Facebook post (the 235 comments, as of the time of publishing it here) that inspired me to write about this on the Lead Safe Mama website for a wider audience, in case anyone might find that interesting!

The thing that struck me the most from the conversation on Facebook is that so many people commented that they live in the United States and are “comfortable” (and – more important – happy) with about that amount $2,900 to $3,200 a month (and less even.) How is that even possible!? The other thing that was striking was that many people count on their public assistance benefits in order to maintain their lives at that level. These benefits (food, medical, childcare, etc.) can actually add up to more than $3,000 or $4,000 a month in value – but several people didn’t calculate/don’t consider those benefits to be part of their “cost of living”.

In writing the article for Facebook, while I didn’t specify I was interested in suggestions that would require moving outside of the United States, I had expected I would get more responses that fell in that realm, as I was thinking, “Where could you realistically live on $3,200 a month INCLUDING all of the expenses above (childcare costs, therapies and interventions, healthcare coverage, respite care, house cleaning, house payment, food, electricity, phones, etc.)?” I think the answer still lies somewhere like Panama or somewhere in Africa (a friend suggested Ghana) or possibly Greece, maybe somewhere in Asia!

The whole conversation is super-fascinating to me, which is why I wanted to write about it. It was also fascinating to me what people did not seem to include in their expenses calculus (items that most folks would consider to be basic expenses, really!)

At this point, I really don’t know how any ordinary person makes it in this country actually! And while I still have my sights on that $10,000 a month (after business expenses and after taxes) as a goal – in spite of the attacks on my advocacy work (and really $15,000 a month is more realistic and actually closer to what we were making before my advocacy was attacked), I am, after writing this, that much more inspired to look for other options – in other countries – as life in this country is truly a rat-race, run by the rich, where the rest of us need to fight to meet even just the most basic needs of our families.

All of this said – and acknowledging that the cost of my legal battle to date has been more than $300,000 in direct and related expenses over 3+ years – no wonder the attorney for the opposing side cynically advised early on, “You cannot afford to prove that you are innocent!”

How does anyone who is wrongly accused of a crime in this country even begin to stand a chance?

And if they already have strikes against them (in our current deeply-polarized, cynically narcissistic, me-first, defund-and-dismantle-any-program-that-provides-assistance-to-the-“undeserving” political climate) – challenges like being a working middle-age mom, or any religion other than Christian, or disabled, or a professional environmental activist that dares to ask, “what exactly is in our water, air soil, and those unregulated ‘consumer goods’ you’re selling everyone — Lead? Mercury? Cadmium? Arsenic? Waddya say let’s do some science and have a look…” – success and financial stability is that much more in the realm of impossibility.

The dystopian society we live in today truly reminds me of The Hunger Games… with folks hoping for that “big break” of being somehow set for life – but the paradigm requires something akin to murdering your neighbors and friends to get there.

And with all that said, I cannot tell you — I simply cannot tell you in words that express this enough — how much I have appreciated your support during this insanely challenging time! In spite of the hardship (and the fact that victory still seems so just out of reach), I will continue to fight for what’s right (protecting children, all of our children, so they can have the best possible future).

As always, please let me know if you have any questions. I find this discussion, debate, and inquiry to be a fascinating one. I welcome your thoughts and comments on this site.

Tamara Rubin

#LeadSafeMama

Never Miss an Important Article Again!

Join our Email List

Cost of living and affordability is generally a lot worse in cities ran by liberals for years and years.

I hope things turn around for you soon. I would love to be a stay at home mom too, but I just can’t financially. I’m fortunate enough to be able to work only part time. I would love to get back to the days where things were very affordable with just one working parent. There are reasons costs keep going up, but too many don’t seem to understand why.

Love your questions. I’d move to Europe in a heartbeat if the family would cooperate. As you say, the political climate, and the downturn our society has taken in general with kindness (not to mention avoiding gun shootings), is tiring. I live in Bend, Oregon, where prices used to be cheap but are steadily rising due to the influx of those looking for cheaper. But still, my utility bill is generally under 400 a month. 800 sounds obscene! Look forward to seeing what areas you come up with that sound interesting. Hope you have a great weekend.

Thank you for commenting (and for reading this!) Cheryll!

On the utility bills – we do have 7 people living in the house (two roomies right now)…

– Tamara

Hello,

More rural areas of Florida and Georgia have real estate markets in free fall, which seem to go against the rising prices in my area. If you’re willing to live more than 35 miles out from the large cities, the prices dramatically drop. For instance in Greenville Fl I saw a listing for around 250,000 which included a 2,500 square foot home on ten acres with a detached game room, built after 1980. For around 130,000 to 150,000 you might find a 2,000 square foot home built around the 1950s in Quincy, FL in the suburbs, I don’t know much about safe neighborhoods though. Go up to Georgia and you can find much better deals I hear, again the key is about 30+ miles out from the major cities and the prices tank although often the homes look great. Down here in rural FL I’ve never, ever received a bill for pruning a tree or fixing a side walk on the street – those concepts are outrageous to me. Electricity statewide is cheap at .10 cents per kW/hr and doesn’t go up with use, in liberal states with more ardent regulation like California the prices tend to be higher. On the negative side I don’t know how easy it is to get public assistance here or in AL. On healthcare.gov I have seen family health insurance plans as low as $70 per month subsidized with low deductibles (Blue Cross silver seems most popular, with several kids on a 4K/mo salary it should be free to 10k per year). I would also check out the Mr Money Mustache blog, he is this extreme frugality fellow who finds creative ways to slash his spending, I haven’t adopted all of his habits but I know I can knock out quite a bit if needed.

Hi Melissa!

Thank you so much for taking the time to respond!

Tamara

I live in Apple Valley, Calif.

It is semi-rural and you can have lots of animals compared to city life.

RENTS are lower than in the city but of course MUCH today is not that low.

A house is min 249,000 and i am sure you can find one in other states like Missouri, Kentucky, Arkansas for alot less!!.

This is a TRI-‘city/town’ area Hesperia, Victorville, & apple valley.

There are a couple places like PHELAN (felan), and Adelanto that surround us.

Adelanto is one of the cheapest.

I’m thinking that the further you are from the city…the CHEAPER it gets.

For instance, Lucerne Valley (on the other side of us) hardly has much in the way of anything but one gas station, a couple thrift stores and one food Market. So prices for homes There are even cheaper than they are here..

We connect here through food co-ops, community supported agriculture (CSA’s) and other events.

If you are NOT in a rural area then you should move to one IF it is the desire of your heart.

God answers the desires of our hearts.

I did not know there was a lawsuit pending…maybe cause i am a brand new subscriber…

But is there a link to read more on THAT particular subject?

You should have many praying for ALL of your needs…like a prayer group?

When my husband and i got married we rented a 3 bedroom small home (12 oo sq ft approx) for 500 a month.

When we finally took the plunge and bought one (23 years later) our rent was 650…so not too bad.

Decent God fearing landlords are a plus…in any state!

My husband made 7.00 an hour in 1990 and i was able to stay home with one small infant.

The pay has increased over time and we had another son and a couple of miscarriages/ie still births.

We were in debt (over time) and were paying another mortgage payment and then some in the credit card payments..

Only a few years ago did he get us OUT of debt COMPLETELY, with an actual savings account 🙂

We all go through hard times and great times…but the important thing to remember is to MAKE MEMORIES everywhere you go 🙂

IF moving to Lucerne Valley, or Adelanto or Phelan is something you MIGHT want to do, let me know so i can look for places for you…k?

Hi Barbara, Thank you for your thoughtful comment. Here’s the link with the full initial filing of my Civil Rights lawsuit:

https://tamararubin.com/wp-content/uploads/2019/08/Lead-Safe-Mama-is-Suing-the-State-of-Oregon-in-Federal-Court-August-2019.pdf

Tamara

P.S. If you ride the housing market like the titanic…you will know WHEN to dive off onto buying a house.

We looked back in the mid 2000’s and everything was UP. By 2009 & 2010 things were dropping.

we bought a 5 acre completely fenced (6ft chain link), 1600+ ft) that once sold at the TOP of the inflation period…at 399,000 and when the market came tumbling down 10,000 each month, we jumped off at just the right time in Dec 2010.

In Jan/Feb 2011 things started to recover a bit. By then that 399,000 home was purchased by us for 115,000-119,500.

So it may NOT be the “right” time for you to move now…cause the housing market is still increasing.

But when the time is right, ask God for a sign for the RIGHT Time to move.

He’ll let you know.

Here is a great TIP: Ask your realtor to keep a look out for 1 bedrooms as well as 2, 3 & 4…

WHY?

Cause i found out through a friend that a huge rumpus room or other large home school room can NOT be counted as a bedroom UNLESS it has a CLOSET!!

So alot of people do not know this in california…but my friends got horse property with uber large rooms for a great deal of a price cause they were only purchasing a 1 bedroom, cause the other rooms had no closets. You can always add an armoire…right?

That’s great advice, Barbara! Thank you.

Tamara

By the way…

Sometimes the grass isn’t greener on the other side.

I mean it can be for a while…but…

It only takes one fraudulent election to put “their” globalist-communist agenda doers IN

in ANY state, in ANY local city and then the once conservative state, city becomes a

nightmare with a communist agenda.

TIMING is everything.

Ask God to advise each step of the way, of your journey